Tax Form For Housing Allowance . If however, the lease is held in the. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Here's how to report this benefit on employee tax returns. Where the employee signs a rental agreement but the employer pays the rent to. Housing allowance is taxed in full. Web employee housing benefits may not be taxable to employees if they meet three conditions. Web understanding the tax treatment. $250) is added to the basic. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Ask the worker to pay the dormitory operator directly. Do note that if housing (e.g.

from worksheetlibraryverda.z19.web.core.windows.net

Web understanding the tax treatment. $250) is added to the basic. Do note that if housing (e.g. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Housing allowance is taxed in full. Here's how to report this benefit on employee tax returns. Ask the worker to pay the dormitory operator directly. Where the employee signs a rental agreement but the employer pays the rent to. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates.

Housing Allowance Worksheet 2021 Irs

Tax Form For Housing Allowance Do note that if housing (e.g. $250) is added to the basic. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Do note that if housing (e.g. Web employee housing benefits may not be taxable to employees if they meet three conditions. Housing allowance is taxed in full. Here's how to report this benefit on employee tax returns. Where the employee signs a rental agreement but the employer pays the rent to. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Ask the worker to pay the dormitory operator directly. If however, the lease is held in the. Web understanding the tax treatment.

From printableenambakg.z4.web.core.windows.net

Minister Housing Allowance Worksheets Tax Form For Housing Allowance If however, the lease is held in the. Here's how to report this benefit on employee tax returns. Do note that if housing (e.g. $250) is added to the basic. Ask the worker to pay the dormitory operator directly. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable. Tax Form For Housing Allowance.

From www.slideserve.com

PPT Year end taxes report PowerPoint Presentation, free download ID Tax Form For Housing Allowance Ask the worker to pay the dormitory operator directly. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Web employee housing benefits may not be taxable to employees if they meet three conditions. Web understanding the tax treatment. Here's how to report this. Tax Form For Housing Allowance.

From vakilsearch.com

What is HRA and its Exemption and its Tax Deduction? Tax Form For Housing Allowance If however, the lease is held in the. Web understanding the tax treatment. Do note that if housing (e.g. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Where the employee signs a rental agreement but the employer pays the rent to. Web if you are simply given a housing allowance and you. Tax Form For Housing Allowance.

From www.jacksonhewitt.com

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt Tax Form For Housing Allowance Web understanding the tax treatment. Housing allowance is taxed in full. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Do note that if housing (e.g. $250) is added to the basic. Web if. Tax Form For Housing Allowance.

From www.dakpad.com

Dakpad An Unbiased Information House Rent Allowance (HRA) Receipt for Tax Form For Housing Allowance Ask the worker to pay the dormitory operator directly. $250) is added to the basic. If however, the lease is held in the. Where the employee signs a rental agreement but the employer pays the rent to. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal. Tax Form For Housing Allowance.

From goodimg.co

️Housing Allowance Worksheet 2018 Free Download Goodimg.co Tax Form For Housing Allowance Housing allowance is taxed in full. Web understanding the tax treatment. Web employee housing benefits may not be taxable to employees if they meet three conditions. $250) is added to the basic. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Web a. Tax Form For Housing Allowance.

From vakilsearch.com

Saving Tax on House Rent Allowance under Old Tax Regime Tax Form For Housing Allowance Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Housing allowance is taxed in full. Where the employee signs a rental agreement but the employer pays the. Tax Form For Housing Allowance.

From lessonschoolimbrowning.z14.web.core.windows.net

Housing Allowance Worksheet 2020 Tax Form For Housing Allowance Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Do note that if housing (e.g. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Web employee housing benefits may not be taxable to employees if they meet three conditions. If however, the lease. Tax Form For Housing Allowance.

From lessonlibraryfonded.z21.web.core.windows.net

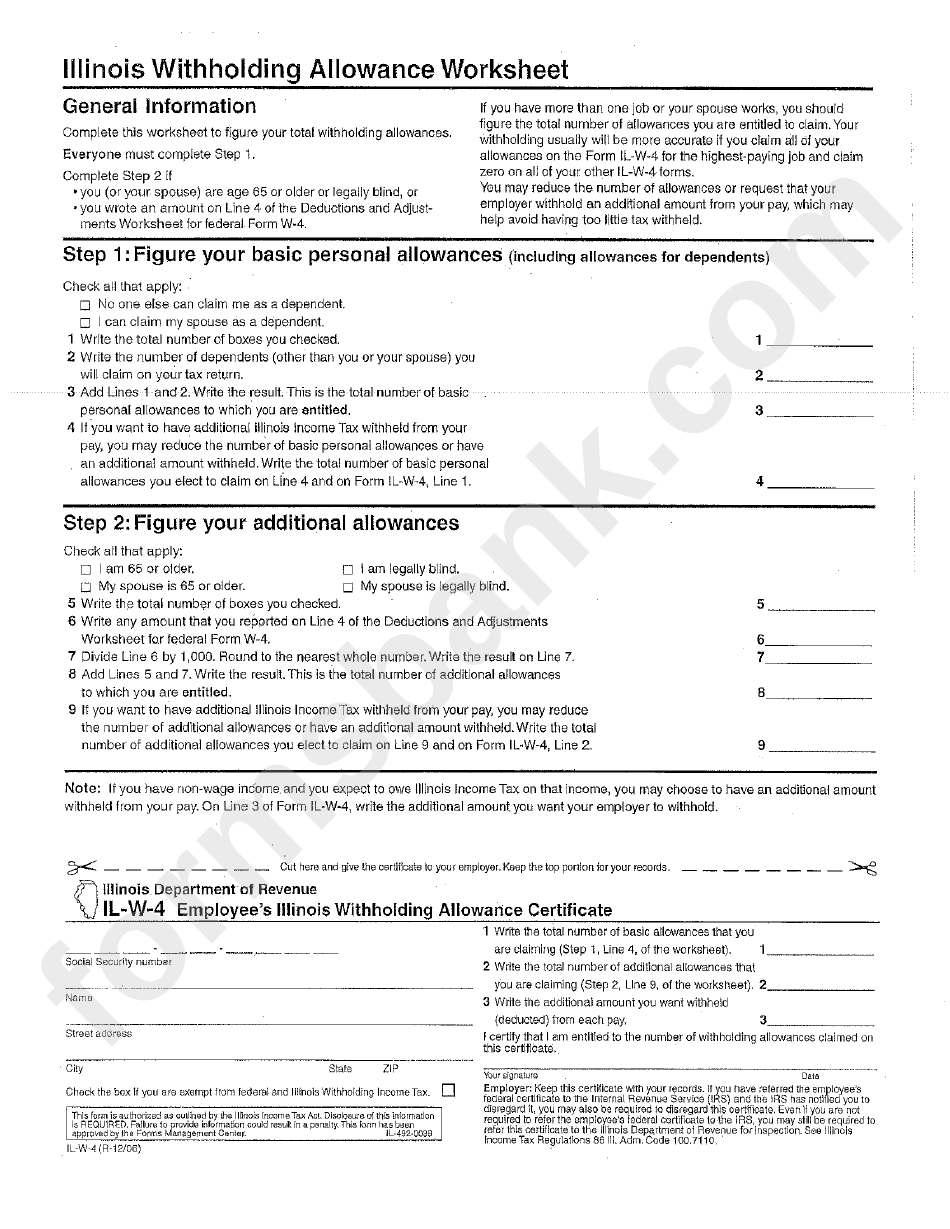

Allowances On W4 Explained Tax Form For Housing Allowance Do note that if housing (e.g. Web understanding the tax treatment. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. If however, the lease is held in the. Here's how to report this benefit. Tax Form For Housing Allowance.

From www.youtube.com

Calculation of House Rent Allowance (HRA) Tax Exemption under Tax Form For Housing Allowance Do note that if housing (e.g. Web understanding the tax treatment. Housing allowance is taxed in full. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. $250). Tax Form For Housing Allowance.

From goodimg.co

️Housing Allowance Worksheet Free Download Goodimg.co Tax Form For Housing Allowance Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Here's how to report this benefit on employee tax returns. If however, the lease is held in the. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Web understanding the tax treatment. Housing allowance. Tax Form For Housing Allowance.

From www.youtube.com

HRA Calculation in Tax House Rent Allowance Calculator Tax Form For Housing Allowance If however, the lease is held in the. Housing allowance is taxed in full. Here's how to report this benefit on employee tax returns. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Generally, all gains and profits derived by an employee in. Tax Form For Housing Allowance.

From fincalc-blog.in

HRA Exemption Calculator in Excel House Rent Allowance Calculation Tax Form For Housing Allowance Ask the worker to pay the dormitory operator directly. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount is taxable at normal income tax rates. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Web employee housing benefits may not be taxable to. Tax Form For Housing Allowance.

From teacherharyana.blogspot.com

House Rent Allowance (HRA) receipt Format for tax Teacher Tax Form For Housing Allowance Where the employee signs a rental agreement but the employer pays the rent to. If however, the lease is held in the. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. Web if you are simply given a housing allowance and you pay your own rent, then the entire amount. Tax Form For Housing Allowance.

From www.pdffiller.com

Pastor Housing Allowance Fill Online, Printable, Fillable, Blank Tax Form For Housing Allowance Do note that if housing (e.g. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income. $250) is added to the basic. Where the employee signs a rental agreement but the employer pays the rent to. Web if you are simply given a housing allowance and you pay your own rent,. Tax Form For Housing Allowance.

From www.hrknowledgecorner.com

House Rent Allowance Tax Form For Housing Allowance Do note that if housing (e.g. Ask the worker to pay the dormitory operator directly. Web employee housing benefits may not be taxable to employees if they meet three conditions. Housing allowance is taxed in full. Web understanding the tax treatment. $250) is added to the basic. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental. Tax Form For Housing Allowance.

From www.sampleforms.com

FREE 32+ Allowance Forms in PDF MS Word Excel Tax Form For Housing Allowance Web understanding the tax treatment. Do note that if housing (e.g. $250) is added to the basic. Where the employee signs a rental agreement but the employer pays the rent to. Web employee housing benefits may not be taxable to employees if they meet three conditions. Web if you are simply given a housing allowance and you pay your own. Tax Form For Housing Allowance.

From answerdbjeff.z13.web.core.windows.net

Housing Allowance Worksheet 2021 Tax Form For Housing Allowance Web employee housing benefits may not be taxable to employees if they meet three conditions. Where the employee signs a rental agreement but the employer pays the rent to. Ask the worker to pay the dormitory operator directly. Generally, all gains and profits derived by an employee in respect of his employment are taxable,. Here's how to report this benefit. Tax Form For Housing Allowance.